Lilly pulls the plug on a would-be blockbuster in its latest pipeline peril

Eli Lilly ($LLY) is shutting down a massive, costly clinical trial after its lead drug came up short in cardiovascular disease, dealing a major blow to the company's pipeline.

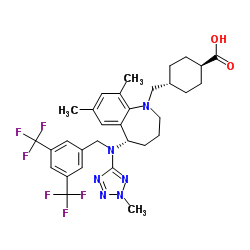

The drug, evacetrapib, is meant to ward off heart attacks and strokes by blocking the protein CETP and thus boosting HDL, or "good," cholesterol. But in an interim analysis of Lilly's global Phase III study, the data monitoring committee noted that "there was a low probability the study would achieve its primary endpoint" of delaying serious cardiac events, the company said. Now Lilly is packing it in early, terminating a trial that had enrolled more than 12,000 patients across 540 sites in 37 countries.

Lilly's big bet on evacetrapib was always a risky one. Over the past few years, CETP inhibitors from Roche ($RHHBY) and Pfizer ($PFE) showed promise of boosting HDL in mid-stage trials but ran into safety issues in Phase III, leading both companies to abandon projects once considered to be blockbusters in the making.

Evacetrapib, Lilly noted, didn't succumb to the same safety concerns that derailed CETP programs past; it just didn't work.

The news sent Lilly's shares down as much as 10% in premarket trading on Monday, as investors grappled with the sudden failure of one of the company's pipeline cornerstones. And evacetrapib's fate would seem to have renewed market-wide worries about CETP as a whole: Merck ($MRK), in Phase III with the similar anacetrapib, fell more than 3%.

A years-long string of pipeline dropouts has gradually dimmed Lilly's future prospects, and evacetrapib has now followed the path of once-promising treatments for cancer, lupus and Alzheimer's disease, each crashing in late-stage trials and forcing the company to pivot.

The latest failure will result in a $90 million charge in the fourth quarter, the company said, but it "does not change our ability to generate long-term growth," Lilly Chief Financial Officer Derica Rice said in a statement. "Our recent string of positive data-readouts and our strong pipeline position us to grow revenue and expand margins through the remainder of this decade."

The end of evacetrapib's cardiovascular disease program further focuses attention on solanezumab, a twice-failed Alzheimer's treatment that is now Lilly's star pipeline asset. After poring over data from the antibody's previous negative trials, Lilly noted that early-stage Alzheimer's patients responded better than other volunteers, so the company designed a follow-up study recruiting only those most likely to benefit from solanezumab. Data from that trial are expected in 2017.

October 12, 2015 | By Damian Garde

Source: http://www.fiercebiotech.com/