Teva Shares Plunge as Sales of Copaxone Disappoint

Teva Pharmaceutical Industries Ltd. shares dropped to the lowest in more than four months as revenue from its best-selling drug Copaxone fell short of expectations and the Israeli company signaled a delay in completing the acquisition of Allergan Plc’s generics unit.

Profit excluding some costs was little changed at $1.12 billion, or $1.28 a share, the Petach Tikva, Israel-based company said in a statement on Thursday. That may not compare to the $1.30-per-share average of 17 estimates compiled by Bloomberg because of an equity offering in December.

The company didn’t give full-year guidance as it works toward completing the $40.5 billion acquisition of Allergan’s generic-drug business. That purchase may be delayed to April, instead of being completed in the first quarter, executives said on a call with analysts.

Shares of Teva fell 4.5 percent to 215.10 shekels, the lowest since Oct. 7, as of 4:50 p.m. in Tel Aviv. The company’s American depositary receipts dropped 2.9 percent to $55.26.

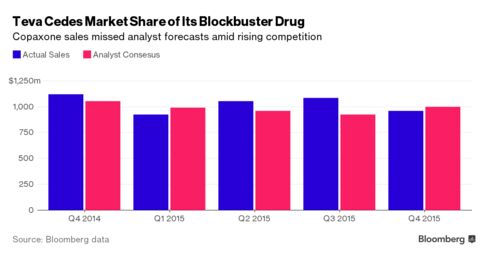

Revenue from multiple sclerosis treatment Copaxone declined 14 percent to $960 million, missing the $1 billion in revenue that analysts had estimated. Lower volumes affected U.S. sales of the drug, which fell 9 percent to $760 million. Teva has converted 78 percent of American patients to a 40-milligram version of the injection that has patent protection until 2030.

The company doesn’t expect to see significant changes in the pricing environment for generic drugs.

Teva forecasts sales of $4.7 billion to $4.9 billion in the first quarter, with earnings of $1.16 to $1.20 a share.

February 11, 2016

Source: http://www.bloomberg.com/