MIRA Pharmaceuticals reports promising preclinical study

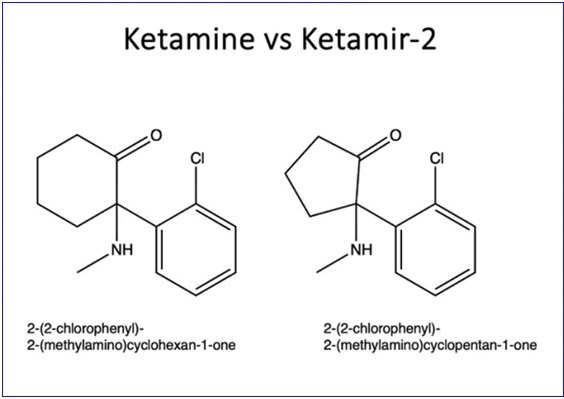

MIRA Pharmaceuticals, Inc. (NASDAQ: MIRA) has announced significant findings in a recent preclinical study. The company's oral ketamine analog, Ketamir-2, showed markedly higher efficacy compared to currently FDA-approved neuropathic pain treatments, Gabapentin and Pregabalin. The study, part of a comprehensive development program, is particularly focused on chemotherapy-induced and diabetic neuropathy.

Today, the Florida-based pharmaceutical company is also considering government funding to support potential PTSD trials, indicating a broadening of their research scope. MIRA Pharmaceuticals plans to file an Investigational New Drug (IND) application by the end of 2024 and aims to initiate Phase I clinical trials in the first quarter of 2025. Phase II trials are expected to start by late 2025.

In other recent news, MIRA Pharmaceuticals has reported significant progress in its drug development programs, specifically Ketamir-2 and MIRA-55. The company has announced promising preclinical results for Ketamir-2, indicating a complete reversal of neuropathic pain in preclinical models, and is preparing to submit an Investigational New Drug (IND) application to the U.S. FDA. In addition, MIRA Pharmaceuticals is in discussions with Memorial Sloan Kettering Cancer Center for a preclinical study on Ketamir-2 for cancer pain and depression treatment.

Analyst firm Ascendiant Capital has initiated coverage on MIRA Pharmaceuticals with a 'Buy' rating, acknowledging the company's innovative approach in developing neuroscience programs. On the corporate front, MIRA Pharmaceuticals' Chief Financial Officer, Michelle Yanez, has agreed to a reduced annual base salary, demonstrating her continued commitment to the company.

MIRA Pharmaceuticals has also successfully regained compliance with the Nasdaq's minimum bid price requirement, ensuring its continued listing on the Nasdaq Capital Market. The company is making strides in the development and regulatory preparation of its drug candidates, Ketamir-2 and MIRA-55.

MIRA Pharmaceuticals' recent preclinical study results and potential expansion into PTSD trials align with the company's dynamic approach to drug development. According to InvestingPro data, MIRA's market capitalization stands at $16.26 million, reflecting its current market valuation. The company's stock has shown a strong 59.7% return over the last three months, potentially indicating investor optimism about its research progress.

InvestingPro Tips highlight that MIRA holds more cash than debt on its balance sheet, which could be crucial for funding its ambitious research and development plans, including the upcoming IND application and clinical trials. However, it's worth noting that MIRA is not currently profitable, with a negative operating income of $9.72 million over the last twelve months.