Sage Therapeutics Collapses 21% After Biogen-Tied Essential Tremor Drug Fails

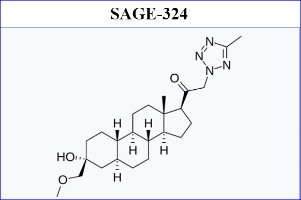

Sage Therapeutics (SAGE) said Wednesday its Biogen (BIIB)-partnered treatment for essential tremor failed in a Phase 2 study, leading Sage stock to collapse.

Essential tremor is a nervous system condition, also known as a neurological condition, that causes involuntary and rhythmic shaking. It can affect almost any part of the body, but the trembling occurs most often in the hands, especially when doing simple tasks, such as drinking from a glass or tying shoelaces.

The companies said patients who received their drug didn't show a statistically significant improvement on scales measuring tremors in their arms or activities of daily living. Biogen and Sage will shut down the ongoing study of SAGE-324.

On today's stock market, Sage stock collapsed 20.6% to 10.38. Biogen stock gained a fraction, closing at 226.03.

RBC Capital Markets analyst Brian Abrahams had low expectations heading into the release. In earlier testing, nearly four in 10 patients stopped treatment due to side effects. Nearly two-thirds of patients had to lower their doses due to side effects, including sleepiness and dizziness.

This "called into question whether the drug could be commercially viable even if it showed some effect in Phase 2" testing, Abrahams said in a report. He cut his price target on Sage stock to 10 from 12, and reiterated his sector perform rating.

This is the second high-profile failure for an essential tremor treatment this year, Needham analyst Ami Fadia said in a report.

Jazz Pharmaceuticals' (JAZZ) suvecaltamide previously failed in testing. The last drug in development is ulixacaltamide from Praxis Precision Medicine (PRAX). That drug is currently in Phase 3 testing.

Fadia kept her hold rating on Sage stock. "We expect Sage to be under pressure today based on this pipeline setback," she said in a report.

Wedbush analyst Laura Chico noted Sage's next catalysts include readouts from its studies of SAGE-718 in patients with Alzheimer's and Huntington's diseases. Those are expected in late 2024.

"Additional earlier-stage pipeline readouts are later, and we anticipate more visibility on potential timing in early 2025," she said in a report. "We await positive signals in these studies before assigning formal credit in our estimates."

Chico maintained her neutral rating on Sage stock, but cut her price target to 9 from 15.

July 26, 2024